Things about Paul B Insurance

Wiki Article

Some Known Details About Paul B Insurance

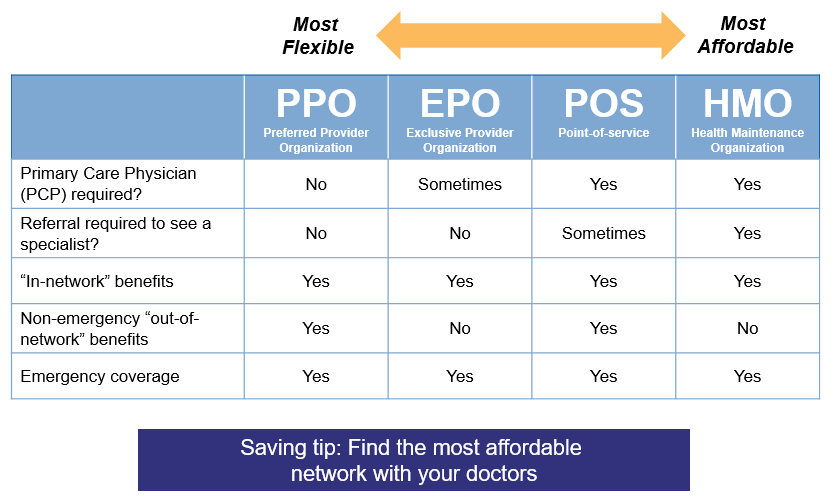

Related Topics One reason insurance problems can be so confounding is that the medical care market is continuously changing and also the insurance coverage intends offered by insurance firms are tough to classify. To put it simply, the lines between HMOs, PPOs, POSs and other types of protection are typically fuzzy. Still, understanding the makeup of different plan types will be valuable in examining your options.

PPOs generally offer a broader choice of suppliers than HMOs. Costs might resemble or slightly more than HMOs, and out-of-pocket prices are typically greater and extra complicated than those for HMOs. PPOs allow individuals to venture out of the provider network at their discernment and also do not require a recommendation from a health care physician.

As soon as the insurance deductible quantity is reached, extra health expenditures are covered according to the arrangements of the wellness insurance policy. As an example, a staff member might after that be liable for 10% of the costs for treatment obtained from a PPO network provider. Deposits made to an HSA are tax-free to the company and employee, as well as money not spent at the end of the year may be rolled over to spend for future medical expenses.

The 9-Minute Rule for Paul B Insurance

(Employer payments must coincide for all employees.) Employees would certainly be in charge of the first $5,000 in clinical costs, however they would certainly each have $3,000 in their personal HSA to pay for medical expenditures (and would certainly have a lot more if they, also, added to the HSA). If workers or their family members tire their $3,000 HSA slice, they would pay the following $2,000 out of pocket, whereupon the insurance plan would start to pay.

(Particular constraints might apply to very compensated individuals.) An HRA should be moneyed entirely by a company. There is no restriction on the quantity of money an employer can add to staff member accounts, however, the accounts may not be funded with staff member salary deferrals under a snack bar plan. Additionally, employers are not allowed to refund any part of the balance to workers.

Do you understand when one of the most terrific time of the year is? No, it's not Christmas. We're speaking about open registration period, child! That's! The wonderful time of year when you get to contrast health and wellness insurance policy plans to see which one is best for you! Okay, you got us.

Not known Facts About Paul B Insurance

However when it's time to select, it is very important to know what each strategy covers, how much it sets you back, as well as where you can use it, right? This things can feel challenging, but it's simpler than it appears. We created some functional understanding steps to assist you feel positive concerning your choices.

(See what we did there?) Emergency treatment is often the exemption to the guideline. These strategies are the most preferred for individuals who obtain their medical insurance via work, with 47% of protected workers enlisted in a PPO.2 Pro: Many PPOs have a decent choice of companies to select from in your location.

Con: Greater costs make PPOs much more pricey than other kinds of plans like HMOs. A health care organization is a health and wellness insurance strategy that usually only covers treatment from medical professionals that benefit (or contract with) that details plan.3 So unless there's an emergency situation, your strategy will not pay for out-of-network care.

Top Guidelines Of Paul B Insurance

Even More like Michael Phelps. It's great to know that strategies in every category provide some kinds of complimentary preventive treatment, and some offer cost-free or affordable health care solutions before you meet your insurance deductible.

Bronze strategies have the least expensive monthly costs but the greatest out-of-pocket expenses. As you function your way up with the Silver, Gold and also Platinum groups, you pay much more in costs, but less in deductibles and also coinsurance. However as we stated before, the additional expenses in the Silver category can be minimized if you receive the cost-sharing decreases.

Decreases can decrease your out-of-pocket healthcare sets you back a whole lot, so get with one of our Supported Neighborhood Providers (ELPs) that can aid you learn what you may be eligible for. The table below shows the percent that the insurance provider paysand what you payfor covered expenditures after you meet your deductible in each plan classification.

The Definitive Guide to Paul B Insurance

Other expenses, usually called "out-of-pocket" expenses, can include up swiftly. Points like your insurance deductible, your copay, your coinsurance amount as well as your out-of-pocket optimum can have a huge influence on the overall expense.

When choosing your health and wellness insurance policy strategy, do not forget medical care cost-sharing programs. These work practically like view website the various other health insurance programs we explained already, but practically they're not a kind of find more info insurance coverage. Permit us to discuss. Wellness cost-sharing programs still have month-to-month premiums you pay as well as defined protection terms.

If you're trying the do it yourself route and also have any sticking around concerns about medical insurance plans, the specialists are the ones to ask. As well as they'll do greater than just answer your questionsthey'll likewise locate you the best price! Or possibly you would certainly such as a way to integrate obtaining terrific medical care insurance coverage with the opportunity to help others in a time of requirement.

Unknown Facts About Paul B Insurance

CHM helps families share healthcare prices like medical examinations, maternal, a hospital stay as well as surgery. And also, they're a Ramsey, Trusted companion, so you understand they'll cover the clinical expenses they're meant to as well as recognize your protection.

why not try this out

Secret Inquiry 2 Among things healthcare reform has performed in the U.S. (under the Affordable Care Act) is to introduce more standardization to insurance plan benefits. Before such standardization, the advantages provided different drastically from strategy to strategy. For instance, some plans covered prescriptions, others did not.

Report this wiki page